外国直接投资对摩洛哥出口增长的影响分析

本文是一篇投资分析论文,本文研究结果表明,外国直接投资和摩洛哥出口增长是相互关联的。外国直接投资在促进长期出口增长方面发挥着积极作用,尽管这种关系可能很复杂,并受到国内生产总值和汇率波动等其他经济因素的影响。

1 INTRODUCTION

1.1 Background and Significance of the Study

1.1.1 Background of the Study

The relationship between Foreign Direct Investment(FDI)and export growth plays avital role in the economic development of nations,especially for rising economies seeking tobecome part of the global market.Out of all the options,Morocco is a particularly fascinatingsubject for analysis.Due to its advantageous geographical location at the intersection ofEurope and Africa,Morocco has aggressively implemented a growth strategy focused onutilizing foreign direct investment(FDI)to stimulate economic diversity,technical progress,and sustainable development.This thesis examines the subtle influence of foreign directinvestment(FDI)primarily on exports and its impact on various sectors of the Moroccaneconomy.

The motivation for this inquiry arises from the worldwide trend towards sustainabilityand economic diversification.This trend views foreign direct investment(FDI)not only as asource of finance,but also as a channel for transferring knowledge,fostering innovation,andgaining entry into new markets.Morocco's focused strategy to attract foreign directinvestment(FDI)in important industries including renewable energy,automotive,aerospace,and agriculture presents a distinct opportunity to analyze the precise results of theseinvestments.The influence of foreign direct investment(FDI)on the expansion of exports inthese industries provides valuable information on the efficacy of Morocco's economic policiesand tactics in bolstering its engagement in global trade.This study seeks to enhancecomprehension of the possible functions and impacts of foreign direct investment(FDI)inchanging the economic environments of emerging nations.It utilizes Morocco as an exemplarof strategic economic change propelled by foreign investment.

投资分析论文怎么写

.......................

1.2 Research Objectives and Statement of the Problem

1.2.1 Research Objectives

This study aims to investigate the causal links between FDI and export growth as well asthe effects of inbound foreign direct investment on Morocco's increase in exports from 2000to 2020.

This research aims to provide a comprehensive,empirical analysis of the relationshipbetween FDI and export growth in Morocco.More specifically,the objectives are:

To critically assess the impact of FDI on Morocco's export growth,considering boththe magnitude and nature of this impact.This would involve analyzing trends,patterns,andvariations in the relationship over time.

To identify and analyze the sectors most influenced by FDI in terms of export growth.

To investigate the relationship between FDI and export growth.

1.2.2 Statement of the Problem

Numerous financial studies have examined the extent to which foreign direct investment(FDI)glide will meet the aforementioned conditions.Many academics remember that thegrowth in exports serves as a quick indicator of the significance of foreign direct investment.In actuality,there can be a wide range of study findings about the connection between FDIand export.The final result verifies positive or negative effects in two ways or just one;somestudies found that FDI has a major impact on exports,others found that exports had an impacton FDI,while yet others found negligible findings.

............................

2 Literature Review

2.1 Theory of Spillover Effect

The reference to Aitken and Harrison(2020)provides a detailed examination of thespillover effects theory of foreign direct investment(FDI)on the economic landscape of hostnations.It specifically highlights the significant impact of educational and institutionalframeworks in amplifying these impacts.Aitken and Harrison's research suggests that thepositive effects of foreign direct investment(FDI)on local economies,such as improvedproductivity and increased export growth,are greatly impacted by the level of education andskills of the workforce,as well as the strength and effectiveness of the institutions of thecountry where the investment takes place.

Their examination probably explores the methods by which Foreign Direct Investment(FDI)helps economic development.They argue that while the injection of capital andtechnology is crucial,the true game-changer resides in the efficient utilization of theseresources.According to them,the extent to which this usage occurs relies heavily on theeducational system and institutional quality of the host country.In countries such as Morocco,where there are efforts to attract high-quality foreign direct investment(FDI),the degree towhich these investments result in increased exports and wider economic advantages dependson the presence of a skilled workforce that can effectively utilize new technologies andbusiness methods.

.........................

2.2 FDI's Impact on the Growth of Exports

In a recent study,Lee and Park(2022)looked at how South Korea's export performancewas affected by foreign direct investment(FDI)in the context of export-driven growth.Leeand Park(2022)confirm that there is a one-way relationship between FDI and exports inSouth Korea,building on earlier studies.Their findings demonstrate the significant FDIinflow into the nation,which is mostly focused on industries like electronics and automotiveproduction.The research highlights the mutually beneficial relationship between foreigndirect investment and export growth,underscoring the importance of the export-led growthstrategy in South Korea's economic development.Additionally,Lee and Park(2022)clarifythe ways in which developments in important export-related fields support South Korea'sForeign Direct Investment(FDI)performance,suggesting a reciprocal relationship betweenFDI inflows and export-related activities.This study highlights the critical role that foreigndirect investment(FDI)plays in determining the export landscape of South Korea and offersinsightful information about the mechanisms behind the country's export-oriented growth plan(Lee&Park,2022).

Zhang and Zeng(2017)used a distribution lag model and a co-integration long-termequilibrium model to examine how Chinese Foreign Direct Investment affected the country'sexport volume.According to their findings,there are observable lag effects between FDI andthe increase in the export scale.In light of China's quickly evolving foreign direct investmentlandscape,this study emphasizes the significance of FDI in boosting a nation's exportcapabilities(Zhang&Zeng,2017).

............................

3 OVERVIEW OF FOREIGN DIRECT INVESTMENT AND EXPORT GROWTH INMOROCCO................18

3.1 Export in Morocco...........................18

3.2 FDI in Morocco..............................18

4 Empirical Analysis of The Impact of FDI on The Export of Morocco..................28

4.1 Model Specification and Variables...........................28

4.1.1 Data Collection Methods.......................28

4.1.2 Data Analysis.......................28

5 Conclusion and Recommendation............................35

5.1 Conclusion....................................35

5.2 Recommendations.................................35

4 Empirical Analysis of The Impact of FDI on The Export of Morocco

4.1 Model Specification and Variables

4.1.1 Data Collection Methods

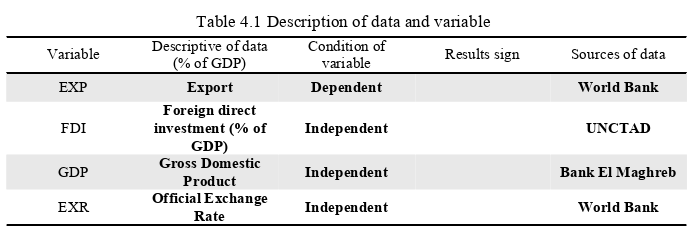

The World Bank and other international financial and economic organizations'databases provided secondary data sources,which were used in the data collection proceduresfor this study.The World Bank(WB)and the Moroccan Investment and Export DevelopmentAgency(AMDIE)provided the data for Export(EXP).The data summing technique optionwas selected to facilitate the acquisition of data from current Moroccan sources.Thesesources were precisely analyzed to extract only the information relevant to the specificvariable under investigation in this study.In order to complete the requisite number timeseries(2000–2022)used in this study,it was deemed necessary to incorporate multiple datafrom Morocco as not all data were available in Morocco for all the variables.Time series datafrom multiple sources covering the years 2000–2022 are used in the study.the GDP from theNational Bureau of Statistics,the World Bank EXR from the Exchange Office of Moroccoand Bank Al Maghreb,and the FDI inflows from the United Nations Conference on Tradeand Development(UNCTAD).

投资分析论文参考

.........................

5 Conclusion and Recommendation

5.1 Conclusion

The goal of the observation is to ascertain if foreign direct investment(FDI)supplementsor replaces exports.The findings indicate that Morocco's exports and foreign directinvestment(FDI)have a complementary relationship.The investigation also revealed a fewsignificant findings,which are as follows:

While opening up to international investment and trade is helpful,they contend that it'sonly a partial solution and that the real benefit lies in understanding existing comparativeadvantages based totally on natural resources and preliminary talents.Prasanna(2010)arguedthat the position of FDI in the export boom of host countries is massive within the mostdynamic segments of export activity.To fully utilize this capacity depends on the hostcountries'strategies and regulations.In order to reap the benefits of foreign direct investmentand foster local businesses and exports,Morocco seeks to address the systemic problems thatits exporters and agencies encounter on a national scale.The King is in charge of a"doingenterprise initiative"that aims to improve the business climate for both domestic and foreigndirect investment.Morocco is placed 53rd in terms of ease of doing business,according to theGlobal Bank of Today.

In order to strategically leverage foreign direct investment(FDI)for economicdevelopment,Morocco should leverage its strategic location as a bridge between Africa andEurope,making it more attractive for logistics,manufacturing,and services.This will requirebolstering human capital through targeted education and vocational training that is suited tohigh-potential industries like technology and renewable energy.Other important componentsof this strategy include streamlining the business environment,guaranteeing legal clarity,andencouraging innovation through collaborations between foreign companies and local researchinstitutions.Finally,putting a high priority on sustainable,high-value sectors will propelMorocco towards a future of robust economic growth and sustainability.

reference(omitted)